Thursday, January 5, 2023

Aventura Real Estate Market

Sunny Isles Beach Real Estate

Miami Real Estate Market

Saturday, December 17, 2022

Tuesday, January 25, 2022

Rising Mortgage Rates Could 'Supercharge' Spring Homebuying Season

[ad_1]

[ad_1]

The fear of missing out on low mortgage rates could “supercharge” the housing market ahead of the spring homebuying season, but not necessarily in markets where inventory is scarce.

That’s according to Mark Fleming, chief economist for First American Financial Corp., in an analysis gauging the potential impact of rising home prices and mortgage rates on homebuyer demand.

First American’s latest Real House Price Index shows affordability was down 21 percent in November from a year ago, with 21.5 percent home price appreciation and a 30-basis point bump in mortgage rates outweighing 4.4 percent income growth.

“Affordability is likely to decline further in 2022, because both mortgage rates and nominal house prices are expected to rise,” Fleming said in a Monday blog post.

Mark Fleming

“While rates are expected to increase steadily throughout 2022, many potential home buyers may try to jump into the market now before rates rise further,” Fleming said. “The fear of missing out on low rates, or ‘FOMO,’ and the potential loss of house-buying power may supercharge the housing market ahead of the spring home-buying season.”

But housing supply “tends to increase in the spring months as more sellers list their homes for sale,” he cautioned. “While home buyers may have FOMO because of rising rates, they may not want to succumb to the fear of better options … because there may be a better home option or options when there’s more homes for sale, even if it means they may pay more.”

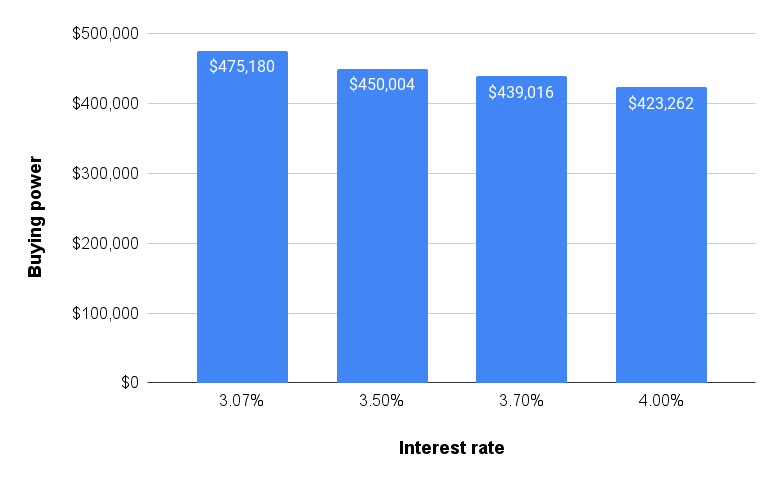

How interest rates impact homebuying power

If mortgage rates rise to 4 percent, a homebuyer who could qualify to buy a $475,180 home in November will only be able to afford a $423,262 home. Source: First American data and analytics.

First American’s analysis of the potential impact of rising rates shows house buying power would fall by $36,000 from November if mortgage rates are at 3.7 percent when the spring home-buying season kicks off, and by $52,000 if they hit 4.0 percent.

While forecasters hadn’t expected to see rates at that level until later this year or next, rates have been headed up sharply as investors reconsider how aggressive the Federal Reserve will be in fighting inflation. Minutes from the Fed’s December meeting revealed policymakers are contemplating shrinking the Fed’s record balance sheet. The Optimal Blue Mortgage Market Indices show rates on 30-year fixed-rate conforming mortgages hit 3.78 percent on Jan. 18.

But inflation is also boosting many families’ incomes, and Fleming says rising household income could offset all or part of the impact rising mortgage rates have on housing affordability. If household income keeps increasing as rapidly as it did in November — approximately 0.6 percent — through the end of 2022, the decrease in homebuying power with mortgage rates at 3.7 percent would be $700, instead of $36,000, Fleming said.

Of course, if home prices keep going up, homebuyers could still find themselves being priced out of homes they could have afforded if they’d gotten off the fence.

In their latest forecast, Fannie Mae economists project home price appreciation will decelerate this year, but that worsening affordability will dent sales 2022 sales of existing homes by 3.2 percent.

The National Association of Realtors estimates that 2021 existing home sales were up 8.5 percent, totaling 6.12 million. But December sales were down 4.6 percent from November, and 7.1 percent from a year ago.

Much depends on how much inventory hits the market this spring, with Zillow reporting that active home inventory dropped below 1 million in December, a nearly 41 percent decline from two years ago and the lowest ever tracked by the popular property portal.

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter

[ad_2]

Source link https://www.cays.com/rising-mortgage-rates-could-supercharge-spring-homebuying-season?feed_id=130&_unique_id=61f0aaaa42687

Last Summer's Breakneck Pace of Home-Price Growth May Finally Ease

The numbers: The S&P CoreLogic Case-Shiller 20-city price index posted a 18.3% year-over-year gain in November, down slightly from 18.5% the previous month. On a monthly basis, the index increased 0.9% between October and November.

Meanwhile, the Case-Shiller national home price index demonstrated 18.8% growth between 2020 and 2021 in November, also down from the prior month.

The Federal Housing Finance Agency released its own house price index, which demonstrated that prices rose 17.5% on an annual basis in November.

“House price levels remained elevated in November, but the data indicate a pivot,” Will Doerner, supervisory economist in the FHFA’s division of research and statistics, said in the report.

“The last four months reflect average gains of 1 percentage point, down from the larger prior changes during the spring and summer months,” he added. “This new trend is a welcome shift but still twice the monthly average we have seen in the last 20 years, which echoes concerns about access and affordability in housing markets.”

Key details: Once again, Phoenix recorded the highest rate of home-price growth in the country in November, with a 32.2% year-over-year increase. Two Florida cities closely followed: Tampa with a 29% uptick and Miami with a 26.6% gain.

Overall, the Case-Shiller index noted that price increases were larger in November than in October for 11 of the 20 major cities that are studied each month.

Regionally, the FHFA index found that the highest rate of home-price growth over the past year has occurred in the Census Bureau’s mountain division, which includes states like Colorado, Idaho and Arizona.

So long as mortgage rates don’t price out too many buyers, demand for the few homes that are on the market should stay strong, which will continue to push home prices higher.

The big picture: Americans aren’t likely to see home-price growth hit the levels seen last summer, but that doesn’t mean prices are dropping. Mortgage rates are on a steady upward climb as of late, which will take some wind out of the housing market’s sales.

But the primary factor behind the fast pace of home-price appreciation over the past couple years—the short supply of homes for sale—isn’t likely to change anytime soon. So long as mortgage rates don’t price out too many buyers, demand for the few homes that are on the market should stay strong, which will continue to push home prices higher.

And in the most sought-after markets, such as Arizona and Florida, demand will remain outsized in this continued era of remote working. Many markets in these regions are poised for explosive growth in the near future—meaning home prices likely will continue to soar.

Looking ahead: “Despite edging mortgage rates and some seasonal moderation in the housing markets, the rate of home-price appreciation continues to track well above sustainable levels.

And given the economy’s strong wage growth, low supply and continued competition among millennials approaching home-buying age, demand pressures will continue to support home price acceleration, with home price indexes likely to continue hovering close to 20% in the coming months.,” said Selma Hepp, deputy chief economist at CoreLogic.

[ad_2]

Source link https://www.cays.com/last-summers-breakneck-pace-of-home-price-growth-may-finally-ease?feed_id=123&_unique_id=61f0a76335224

How To Survive As Generation Z Hits The Real Estate Market

[ad_1]

[ad_1]

This is the second installment in Inman’s series on the ways people from different generations approach the homebuying experience. Click here for part one, and check back in the coming days for additional stories on Generation X and the baby boomers as part of Agent Appreciation Month. Take advantage of our Agent Appreciation Sale, and subscribe to Inman Select for only $85.

McKenzie McLoughlin has been trying to find a house for more than a year.

McLoughlin lives in Flagstaff, Arizona, and with her fiancé began looking to move out of her rental and into a home of her own in January 2021. The couple wanted a garage, space for their dog and a place to store their skis.

“We wanted places with good natural light, and location was important too,” McLoughlin recently told Inman. “And we wanted to be somewhere where I could go running.”

But like for many younger buyers — including a new homeowner in Utah Inman recently spoke with — the process of finding a place has been rough.

“I think we’ve made seven offers all of which were over asking,” she said.

TAKE INMAN’S GEN Z QUIZ TO SEE IF YOU SPEAK THE LANGUAGE OF YOUR YOUNGEST CLIENTS

Finally, the week of Thanksgiving 2021, the couple got lucky — if you count bidding five figures over asking as luck. They won the bid for a townhome in the very complex where they had been renting. There was a catch, though, as the existing owners needed to find a place to move as well. But after a very long escrow period McLoughlin and her fiancé are scheduled to close by the end of January.

“I would classify this entire experience as stressful, and I haven’t found the excitement yet,” she concluded. “Every time we put an offer in on a house it was hard to let myself get excited because rejection was waiting. This whole process has so many twists and turns. It’s a roller coaster for sure.”

In many ways, McLoughlin’s journey to home ownership looks a lot like that of many young millennials. But there are two things that make her experience significant and different: First, she’s only 26, meaning that, depending on which definitions you use, McLoughlin could be considered a member of Generation Z rather than a millennial. And secondly, because of McLoughlin’s age, she missed some of the moments that defined the millennials and has come into adulthood in a comparatively different era.

“I didn’t have to deal with the graduating from college in the collapse of the economy, but I also remember dial up,” she said of her age.

McLoughlin is consequently at the vanguard of a massive generation just now reaching homebuying age. It’s a generation that looks a lot like the millennials and which, thanks to its large size, has the potential to have a similarly massive impact. But it’s also a cohort that grew up in its own unique time, and for whom the homebuying story is mostly still in its first chapter, if it has even begun at all. Either way, though, there’s little question that Gen Z is the future of the housing industry.

Table of Contents

Who is Generation Z?

Generation Z, often shortened to just Gen Z or even “zoomers,” generally includes everyone born from the mid 1990s to the early 2010s. Demographers often use a cut off of 1996 or 1997 for the start point and around 2012 for the end point. That means the oldest members of the cohort are about 26.

In many ways, Gen Z’s identity is linked to their older brethren the millennials. For example, younger millennials were the first generation to grow up with the internet, but for them it was in many cases an earlier, more rudimentary thing. They had Hotmail email addresses, used Myspace for social networking, and stole their music via Napster and Limewire.

Gen Z is more embedded in what we think of as the modern internet. Many were born after the advent of YouTube, for example, and think of Facebook as a stodgy old company. Where younger millennials grew up with flip phones, many members of Gen Z don’t remember a time before smart phones.

Gen Z and millennials are comparable in size. According to the Pew Research Center, there were just over 72 million millennials in 2019. Gen Z is slightly smaller, with between 67 million and 68 million members, but both generations are larger than Gen X. And ultimately, the similarities between the two generations have prompted some observers to argue that they are in fact the same generation.

But similarities notwithstanding, Gen Z is notable for what it missed. As McLoughlin’s experience highlights, Gen Z generally didn’t come of age in the immediate wake of the Great Recession. For many Gen Zers, 9/11 is something they read about in a history book. The first presidential election anyone from the cohort could vote in was Obama versus Romney.

Though older Americans may be shocked to think of people born after 9/11 buying houses, Gen Zers are in fact an important, if still nascent, force in the real estate market. According to a report from the National Association of Realtors (NAR) that is based on thousands of survey responses collected in 2019 and 2020, Gen Z makes up 2 percent of both homebuyers and homesellers.

Credit: NAR

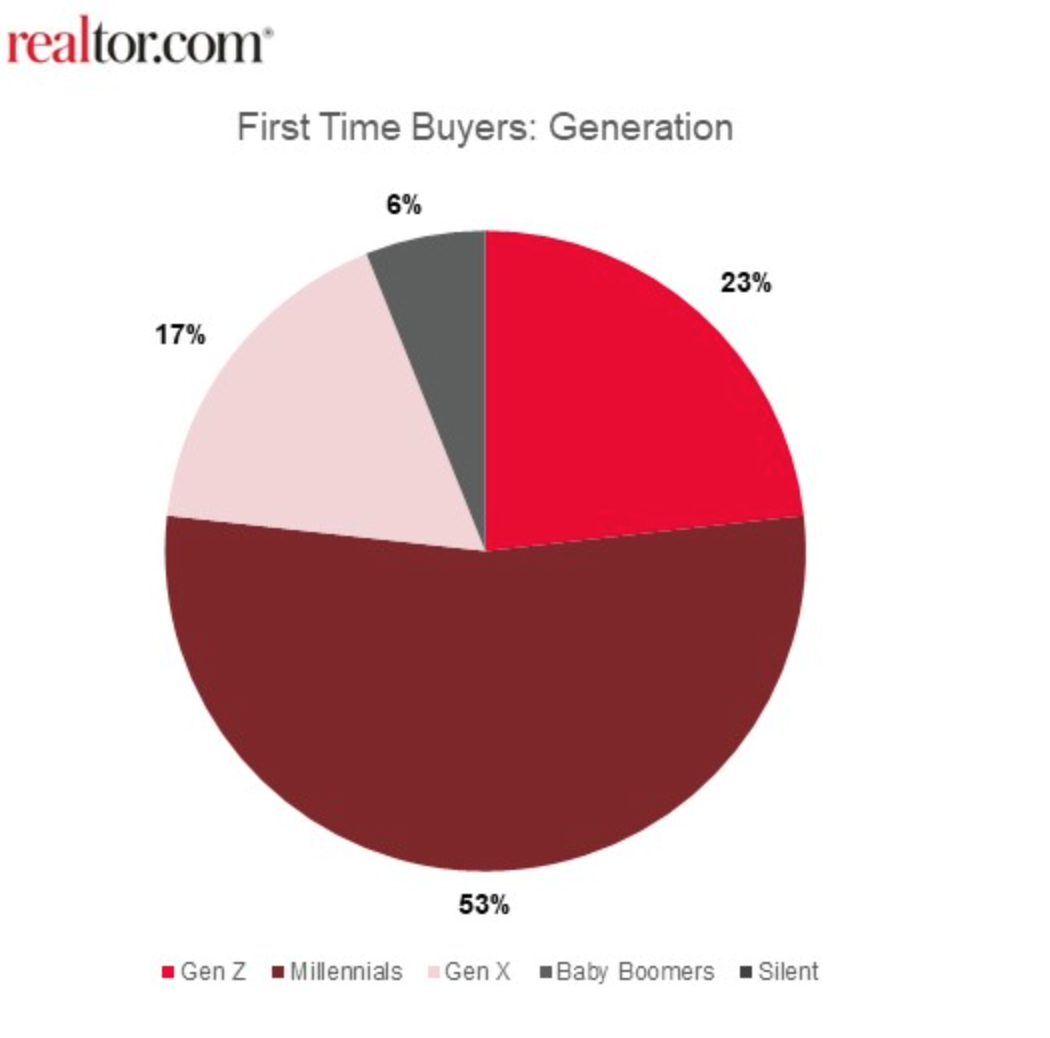

When looking just at first-time homebuyers, Gen Z has an even bigger impact.

According to a recent report from realtor.com, Gen Z now makes up 23 percent of first timers. (It’s worth noting that NAR defines the starting date for Gen Z as 1999, which is later than in many other analyses. That means NAR’s report is grouping some people into the “younger millennial” category that in other situations might be considered Gen Zers. The overall takeaway is the same — Gen Z is a small-ish but rising force in housing — but it means numbers from various sources aren’t always perfectly comparable.)

Credit: realtor.com

These numbers are not huge, but realtor.com also found that 72 percent of Gen Zers would like to buy a home at some point in the future. With the older members of the cohort just a few years away from their 30s, that means Gen Z is poised to have a major impact on real estate going forward.

Generation Z’s defining traits:

- Gen Z grew up with not just the internet, but many of the companies and devices that remain popular today.

- Members of Gen Z are similar to millennials, but missed many world events that defined the millennial generation.

- Gen Z is still a small share of the homebuying population, but within a few years will become a major force.

Where is Gen Z going?

Older members of Gen Z have already entered the job market, and many others are in college getting ready to make that transition. But unlike millennials, who are now in the middle of their careers and generally looking to move locally, members of Gen Z are still relatively new to the professional life. And that means they’re not as attached to specific locations as millennials are.

George Ratiu

“Forty-one percent are moving to a different city or town,” realtor.com Senior Economist George Ratiu told Inman. “And 19 percent are also looking to change states.”

Realtor.com also found that Gen Zers don’t generally plan to stay in a single place for very long. Via a 2021 report on a survey of nearly 4,000 Americans, the company discovered that only 17 percent of Generation Z think their tenure in their current location will last 10 years or long. Only 12 percent thought they would stay in the same place for between five and 10 years.

On the other hand, 30 percent thought they would stick around in the same place for between two and five years. Another 26 percent envision their tenure in their current location lasting just one to two years.

The picture that emerges is one of a still-mobile generation.

rIn terms of types of locations, realtor.com’s report also revealed that 51 percent of Gen Zers live in the suburbs. That’s not surprising given that some members of Gen Z likely still live at home with their parents or have had less time to sample different environments.

But what is surprising, given millennials’ well publicized march into city centers over the last decade, is that 49 percent of Gen Zers actually prefer the suburbs.

Gen Z migration:

- Members of Generation Z are looking to move, often to new cities and states.

- Large percentages of Gen Zers have indicated a preference for suburbs over more urban environments.

- Gen Zers typically don’t envision themselves living in the same place long-term at this point.

What is Gen Z looking for in a house?

Derrik Shockman

In many cases, Gen Z is looking for some of the same things millennials, particularly younger millennials, want in a house. For instance, Derrik Shockman, an agent with Windermere Abode in Tacoma, Washington, told Inman that rapidly rising home prices in recent years have made affordability a paramount concern among his youngest homebuyers. And like millennials, Gen Z is trying to extract rental income from their homes via things like accessory dwelling units (ADUs).

“What I’m seeing a lot now is people trying to offset their mortgage by having additional income, maybe from a basement apartment,” Shockman said.

This is similar to what’s happening among millennials, but Kyle Whissel, CEO of San Diego-based Whissel Realty Group at eXp Realty, said Gen Zers have leaned particularly hard into a trend known as “house hacking.” The concept is simple: a person buys a home and lives in it while also renting portions to other people.

Whissel said this is happening among millennials too, and that many in that demographic are turning to Airbnb thanks to the higher returns from short-term renting. But Gen Z seems to be even more into renting out space.

“I think they’re the most into the house hacking model,” Whissel said of Gen Zers. “Especially the younger they get, the more they want the extra units.”

Jackie Soto

While Gen Zers may be comparable to millennials when it comes to questions of affordability, multiple agents also noted that some of their youngest buyers seem to have a willingness to renovate homes. For instance Jackie Soto, broker-owner of eHomes in California’s Inland Empire, said in her region young real estate consumers appear to be “less afraid of fixer-uppers.”

“You’ll find the youngsters who aren’t afraid of the project,” she said.

Curiously, multiple agents who spoke to Inman for the previous installment of this series said their millennial homebuyers tend to avoid project homes and typically want something that’s move-in ready.

Meanwhile, Soto’s comment about Gen Zers and renovation was echoed by other agents who spoke to Inman for this piece. Jenny Wetzel, who is also at Windermere Abode in Tacoma, was among them, and mentioned that “home renovation has totally become a hobby” among her youngest clients.

Jenny Wetzel

These anecdotal accounts and sweeping theories about millions of people are always going to be imperfect. But if agents’ observations are indicative of a trend, it could hint at Gen Z’s relative time wealth compared to millennials. In other words, it may be that Gen Zers simply have more time for renovations.

Among other things, Wetzel also said her youngest buyers are looking for amenity-rich neighborhoods and properties that allow for a better work-life balance than previous generations might have demanded.

“I think the younger generations are more apt to not be as inclined to work as much,” Wetzel, who is about to turn 33 and often works with younger buyers, said. “A lot of people like me, we just kind of grind it out and work a lot. But their work-life balance is different than mine.”

Daryl Fairweather

Daryl Fairweather, chief economist at Redfin, also noted that Gen Z is more racially diverse than any other prior generation, and that fact could ultimately end up influencing their homebuying decisions.

“I could see them caring more about diversity when it comes to selecting a neighborhood,” Fairweather said.

NAR’s report further found that buyers between the ages of 22 and 30 — a category that includes members of both the millennial and Gen Z cohorts — is most actively buying older homes as opposed to newer homes; prioritizes commuting costs; and considers moving thanks to changes to a job or a desire for more space or nicer features.

Gen Z home preferences:

- Members of Gen Z are looking for affordability and some have turned to “house hacking” as a solution.

- Some agents have noticed a willingness among Gen Z to take on project properties.

- Generation Z is the most racially diverse generation in U.S. history, which may ultimately influence members’ home choices.

How are Gen Zers paying for their homes?

Many of the agents who spoke to Inman for this story said their Gen Z clients, like millennials, tend to get mortgages when buying a home rather than pay cash. That makes sense, given that neither generation has had a particularly long professional life yet.

But Gen Z differs from millennials because the cohort has had even less time to save up. And that means members of the generation who are in the housing market occasionally have unusual circumstances. For example, Whissel said that he sometimes sees younger buyers coming in with windfalls from cryptocurrency investments.

Kyle Whissel

“Some of the younger demo has crushed it with crypto or NFTs,” he explained. “These kids have got in on bitcoin and can buy now.”

Whissel also said the youngest buyers he sees have in some cases come to transactions with mortgages they found on their own via internet-based lenders.

“A lot of the 20-somethings are far more financially savvy than the 40-somethings,” Whissel said. “They’ve grown up in the YouTube age and they tend to be more educated coming in.”

The report from NAR bears this out, showing that 34 percent of homebuyers between the ages of 22 and 30 got themselves prequalified for a mortgage online after doing an internet home search. That’s a higher percent than any other age group.

At the same time, 23 percent of buyers between 22 and 30 received down payment funds from a family or friend. That’s also a higher percentage than any other age group and hints at Gen Zers’ relative newness to the market.

Gen Z finances:

- Some Gen Zers are coming to real estate with earnings from exotic investments.

- Gen Zers tend to be more comfortable finding lenders online.

- Gen Zers get family assistance for their down payments more than members of other generations.

How does Gen Z approach real estate and real estate agents?

For the most part, Gen Z tends to begin the homebuying process similarly to the millennials, for example by first looking for information online.

However, Gen Zers’ beginning steps are unique. For instance, NAR’s report shows that 33 percent of buyers between the ages of 22 and 30 started the process by looking online for properties. Curiously, that’s a lower percentage than every other generation. For example, 43 percent of older millennials started by looking online, while 48 percent of Gen Xers did the same.

So what’s going on?

It may be that Gen Z is still figuring out where to even start. Case in point: 17 percent started the process by looking online for information about the homebuying process. By comparison, only 11 percent of older millennials and 7 percent of Gen Xers started their homebuying journey with that step. Similarly, 16 percent of Gen Zers started by talking to a family member or friend about the homebuying process, compared to only 8 percent of older millennials.

The picture that emerges from all these data points is that Gen Z is generally an online generation, but also appears to start the home search process seeking out more basic information than older consumers. Put another way, the “Saturday Night Live” joke about real estate porn and Zillow being for people in their 30s rings true.

Other key characteristics of Gen Zers include, according to the agents who spoke to Inman, a willingness to find agents via online referrals and reviews.

Anne Jones

Anne Jones, who co-owns Windermere Abode, was among those who made that point, noting that Gen Zers are very online, find agents via social media, and often have as much confidence in online recommendations as they do with those of people they know in real life. They’re comfortable with technology in other ways as well, for example by being willing to close deals virtually rather than in person.

But none of that, Jones added, means Gen Z doesn’t need or want real estate agents while buying property. In fact, NAR’s report revealed that 15 percent of buyers between the ages of 22 and 30 began their home buying journey by reaching out to a professional. That’s just one percentage point lower than millennials, and two points lower than Gen X. The takeaway, then, is that many members of Gen Z are still interested in having an agent guide them through the process.

“Even though they’re young and they’re super engaged online,” Jones concluded, “their real estate education has been through Googling. So they still really need the hands-on coaching.”

Gen Z and real estate:

- Gen Zers tend to start their home searches online

- Many members of Gen Z appear to have less knowledge than older consumers, and start their searches looking for basic information.

- Being comfortable with technology hasn’t made Gen Z, as a whole, eschew real estate agents.

Email Jim Dalrymple II

[ad_2]

Source link https://www.cays.com/how-to-survive-as-generation-z-hits-the-real-estate-market/?feed_id=113&_unique_id=61f0a05c26e6d