The fear of missing out on low mortgage rates could “supercharge” the housing market ahead of the spring homebuying season, but not necessarily in markets where inventory is scarce.

That’s according to Mark Fleming, chief economist for First American Financial Corp., in an analysis gauging the potential impact of rising home prices and mortgage rates on homebuyer demand.

First American’s latest Real House Price Index shows affordability was down 21 percent in November from a year ago, with 21.5 percent home price appreciation and a 30-basis point bump in mortgage rates outweighing 4.4 percent income growth.

“Affordability is likely to decline further in 2022, because both mortgage rates and nominal house prices are expected to rise,” Fleming said in a Monday blog post.

“While rates are expected to increase steadily throughout 2022, many potential home buyers may try to jump into the market now before rates rise further,” Fleming said. “The fear of missing out on low rates, or ‘FOMO,’ and the potential loss of house-buying power may supercharge the housing market ahead of the spring home-buying season.”

But housing supply “tends to increase in the spring months as more sellers list their homes for sale,” he cautioned. “While home buyers may have FOMO because of rising rates, they may not want to succumb to the fear of better options … because there may be a better home option or options when there’s more homes for sale, even if it means they may pay more.”

How interest rates impact homebuying power

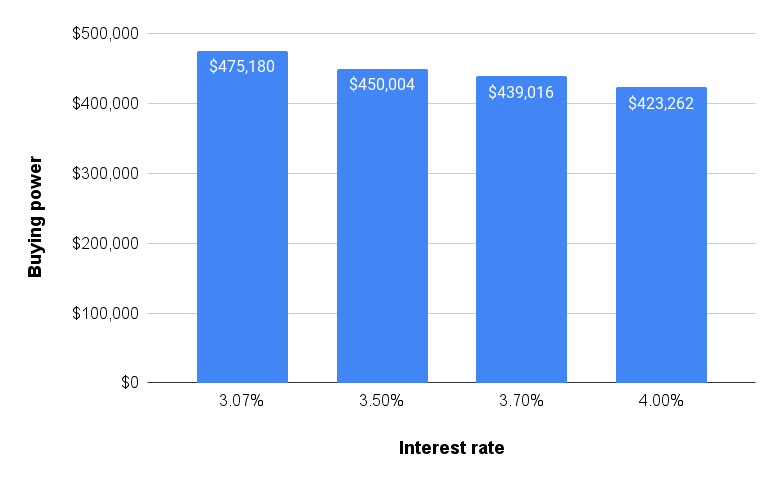

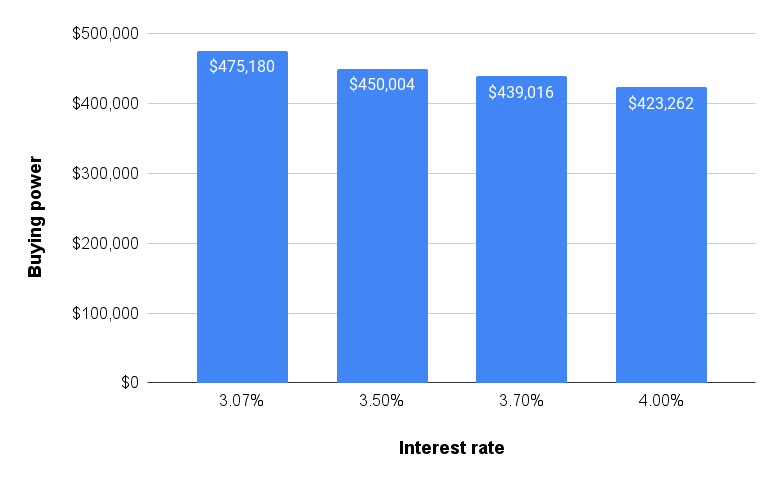

If mortgage rates rise to 4 percent, a homebuyer who could qualify to buy a $475,180 home in November will only be able to afford a $423,262 home. Source: First American data and analytics.

First American’s analysis of the potential impact of rising rates shows house buying power would fall by $36,000 from November if mortgage rates are at 3.7 percent when the spring home-buying season kicks off, and by $52,000 if they hit 4.0 percent.

While forecasters hadn’t expected to see rates at that level until later this year or next, rates have been headed up sharply as investors reconsider how aggressive the Federal Reserve will be in fighting inflation. Minutes from the Fed’s December meeting revealed policymakers are contemplating shrinking the Fed’s record balance sheet. The Optimal Blue Mortgage Market Indices show rates on 30-year fixed-rate conforming mortgages hit 3.78 percent on Jan. 18.

But inflation is also boosting many families’ incomes, and Fleming says rising household income could offset all or part of the impact rising mortgage rates have on housing affordability. If household income keeps increasing as rapidly as it did in November — approximately 0.6 percent — through the end of 2022, the decrease in homebuying power with mortgage rates at 3.7 percent would be $700, instead of $36,000, Fleming said.

Of course, if home prices keep going up, homebuyers could still find themselves being priced out of homes they could have afforded if they’d gotten off the fence.

In their latest forecast, Fannie Mae economists project home price appreciation will decelerate this year, but that worsening affordability will dent sales 2022 sales of existing homes by 3.2 percent.

The National Association of Realtors estimates that 2021 existing home sales were up 8.5 percent, totaling 6.12 million. But December sales were down 4.6 percent from November, and 7.1 percent from a year ago.

Much depends on how much inventory hits the market this spring, with Zillow reporting that active home inventory dropped below 1 million in December, a nearly 41 percent decline from two years ago and the lowest ever tracked by the popular property portal.

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter

[ad_1]

[ad_1]